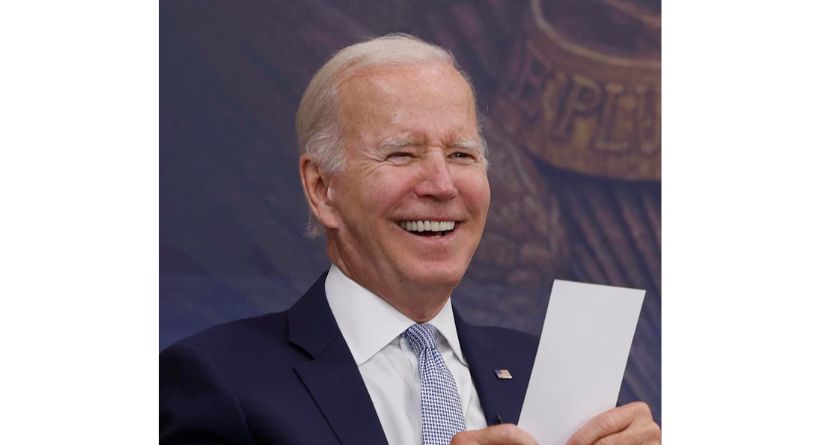

Here are 3 reasons President Joe Biden could cancel student loans and extend the student loan payment pause.

Here’s what you need to know — and what it means for your student loans

Student Loans

Biden is days away from announcing his decision on wide-scale student loan forgiveness and the student loan payment pause. Whatever he decides, more than 40 million student loan borrowers are about to receive news that will have a lasting impact on their financial life. Here are three reasons why Biden could decide to implement broad student loan forgiveness and another student loan payment pause.

1. Student loan forgiveness and the student loan payment pause: Biden has supported both policies

First, Biden has publicly backed both the suspension of student loan payments and the general student debt forgiveness. Since he began running for president in 2020, Biden has backed borrowers receiving a $10,000 student debt forgiveness. Progressive Democrats, like Sen. Elizabeth Warren (D-MA) and Senate Majority Leader Chuck Schumer (D-NY), have called on Biden to erase $50,000 in student debt, but Biden has voiced his opposition to this figure. Biden, in contrast, has often mentioned the $10,000 in student debt relief. Similar to this, Biden has four times since taking office increased the student loan payment suspension. The student loan payment suspension will expire soon. Regarding the beginning of student loan payments, Biden has stayed mute. Despite this, Biden has not declared he won’t renew student debt relief for a fifth time.

2. Student loan payment pause: borrowers will have ample notice

Second, holders of student loans have been reassured by the Biden administration that they would get enough notice before their loan payments resume. For instance, Miguel Cardona, the secretary of education for the United States, said borrowers of student loans will have enough time to be ready for the commencement of new instalments. In the past, if Biden wanted to prolong the student loan payment moratorium, he gave several weeks’ notice. It would be unusual for Biden to wait this long if he intended to cancel the student loan payment suspension, albeit there are only around 10 days left until it expires. Despite this, holders of student loans are aware that the moratorium on payments is only temporary, and that if there isn’t another extension, payments might resume on September 1, 2022.

3. Biden has canceled $32 billion of student loans

Since becoming president, Biden has cancelled $32 billion in student debt. That shows how committed Biden is to forgiving student loans—more it’s than any prior president. In spite of this, Biden has concentrated on targeted student debt cancellation to help certain categories of borrowers. For instance, this pertains to employees of the government and borrowers who claim that their institution or university deceived them of the borrower defence to student loan payments. Despite delaying the release of his new student loan scheme, Biden has already made significant adjustments. Republicans unveiled a fresh student debt forgiveness proposal that vastly deviates from the Biden administration’s first design. According to records from the Education Department that were leaked, all federal student loan borrowers who make less than $150,000 per year would have their $10,000 in student debt forgiven.

Student loans: next steps

A decision about the suspension of student loan payments and widespread debt forgiveness is imminent. Prior to August 31st, Biden promised to reveal his student debt forgiveness strategy. His choice about the prospective extension of the student loan payment suspension will probably be made at the same time as or soon after his choice regarding student debt discharge. Notably, there is no assurance that any of these student loan strategies will be carried out by Biden. For instance, Biden has said nothing about the suspension of student loan payments. Therefore, without additional word from Biden, holders of student loans should be ready for the commencement of new instalments on September 1. The following are some of the greatest techniques to be ready to pay off student debt more quickly:

- Refinancing student loans (lower interest rate + smaller payments)

- Earnings-based repayment (lower payment)

- Debt forgiveness for students (federal student loans)